The IPO market has been quieter than usual over the past couple of years—but that calm is exactly why 2026 is shaping up to be such a big moment.

After a period of high interest rates, cautious valuations, and companies choosing to stay private longer, many of the world’s most recognizable private brands are now edging closer to the public markets. These are companies people already use, talk about, and care about—which helps explain why interest in upcoming IPOs is heating up again.

At GiveAshare, we closely follow these developments. When companies officially go public, we may add them to our stock list, making it possible to celebrate new public companies with a framed stock certificate.

Join Our IPO Watchlist

Excited about one (or more) of these upcoming IPOs? Click here to join our IPO watchlist to be notified when they become available at GiveAshare.com

Why 2026 Could Be a Breakout Year for IPOs

Companies today are no longer rushing to go public. With access to private funding, secondary markets, and strategic partnerships, many have chosen to delay IPOs until conditions feel right.

Now, several forces are converging:

Stabilizing interest rates

Renewed demand for growth stories

Explosive interest in AI, space, and creator-driven platforms

As a result, 2026 is widely expected to be a year when long-awaited companies finally make the leap to the public markets.

The Most Anticipated IPOs to Watch

SpaceX

Few companies generate as much excitement as SpaceX. Founded by Elon Musk, the aerospace giant has reshaped space travel through reusable rockets, government contracts, and its Starlink satellite network.

A SpaceX IPO—if and when it happens—would represent more than a typical tech offering. For many people, it symbolizes innovation, exploration, and the future of space itself.

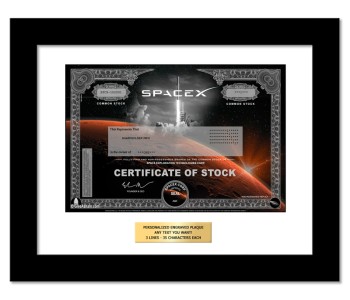

While SpaceX is still private, we already offer a replica SpaceX stock certificate for fans and shareholders who want to display their interest in the company. If SpaceX does go public, we plan to add it to our stock list as soon as it becomes available.

OpenAI

As the company behind ChatGPT, OpenAI has become one of the most influential names in artificial intelligence. Its rapid rise has sparked widespread curiosity about how—and whether—it could eventually go public.

OpenAI’s structure is more complex than a traditional startup, involving partnerships, capped-profit models, and major backing from Microsoft. Any future IPO would likely look very different from a standard tech debut.

In the meantime, we offer a replica OpenAI stock certificate for those who follow the company closely. If OpenAI ever becomes publicly traded, we would add it to our stock lineup once shares are available.

Anthropic

Anthropic is another AI company drawing serious attention, particularly for its focus on safety and responsible development. Known for its Claude AI models, Anthropic appeals to investors interested not just in growth, but in long-term responsibility.

As AI continues to dominate headlines, Anthropic remains a closely watched IPO candidate—especially among those interested in the future of ethical AI.

Canva

Canva has quietly become one of the most widely used design platforms in the world. From students to entrepreneurs to large teams, its reach extends far beyond traditional design software.

Because Canva is already profitable and deeply embedded in daily workflows, its eventual IPO feels personal to many users. If Canva goes public, it’s a company we expect significant interest in adding to our stock list.

Stripe

Stripe has been “about to IPO” for years, and that patience may ultimately work in its favor. The payments company powers transactions for countless online businesses and remains one of the most valuable private fintech firms worldwide.

Stripe’s decision to stay private longer reflects a broader shift: companies waiting for the right market moment, not just the first opportunity.

What Makes These IPOs Different

What ties these companies together isn’t just valuation—it’s connection.

People don’t simply recognize these brands. They:

Use their products

Follow their growth

Talk about them online

Feel personally invested in their success

That emotional connection is a big reason IPOs today feel less like financial events and more like cultural milestones.

Want to Be Notified When a Company Goes Public?

If you’re excited about a specific IPO and want to know when (or if) it becomes available as a stock gift, you can join our internal IPO watchlist.

We track upcoming IPOs closely and will add companies to our stock list once they officially go public and shares are available.

Looking Ahead

As 2026 unfolds, some of these companies may go public, others may continue to wait, and new names will inevitably emerge. IPO timelines change—but interest in ownership doesn’t.

For many people, following a company’s IPO journey is the first step toward understanding how ownership begins. And when that opening bell finally rings, we’ll be ready to help mark the moment.