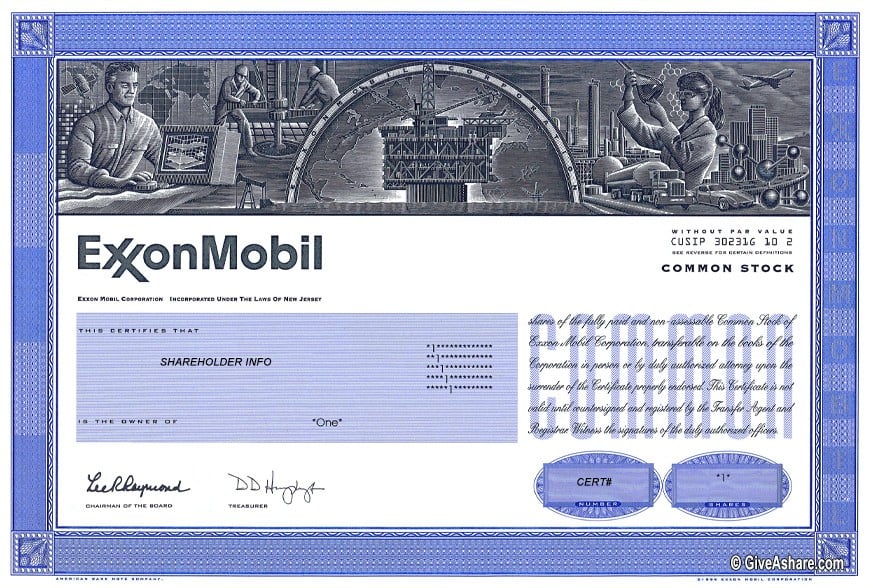

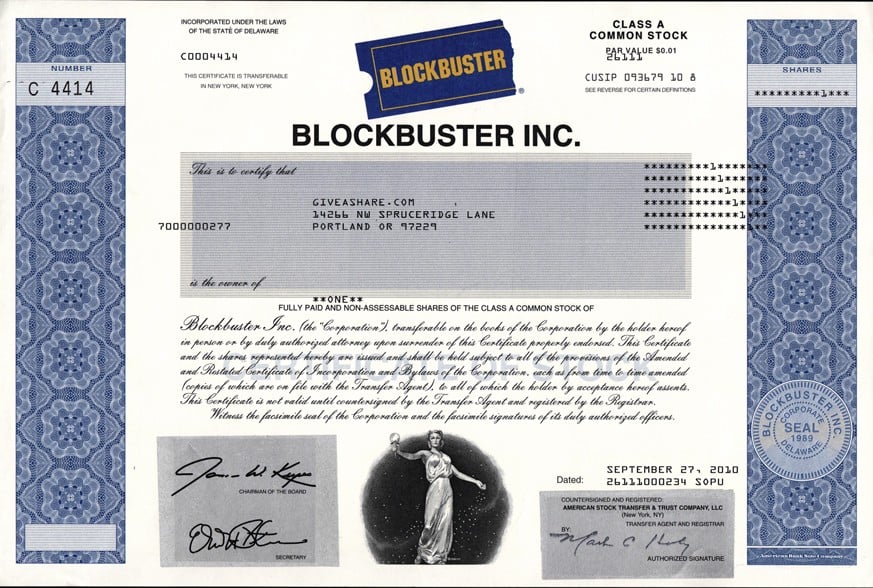

Stock Certificates

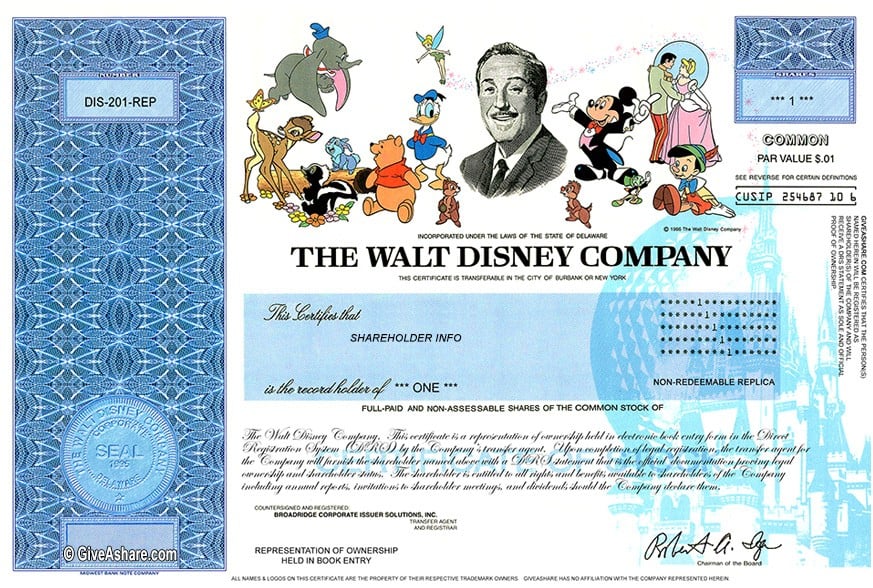

A stock certificate is more than just a piece of paper that proves ownership in a company. It can be an attractive work of art and a snapshot of history. It's also an important part of a stock gift that grabs attention and can be proudly displayed. Stock brokers stopped issuing stock certificates (or imposed huge fees) years ago.

GiveAshare is the ONLY place to easily and affordably get either:

- Authentic registered paper stock certificates, or

- Personalized replica stock certificates - looks like the real thing

- For those who already own shares at a broker but want a keepsake to display.

Quicklinks

1. Buy true one share ownership + real registered stock certificate

- 60% of the companies on our list still issue registered paper stock certificates

2. Buy true one share ownership + personalized replica stock certificate

- Available for all companies on our stock list.

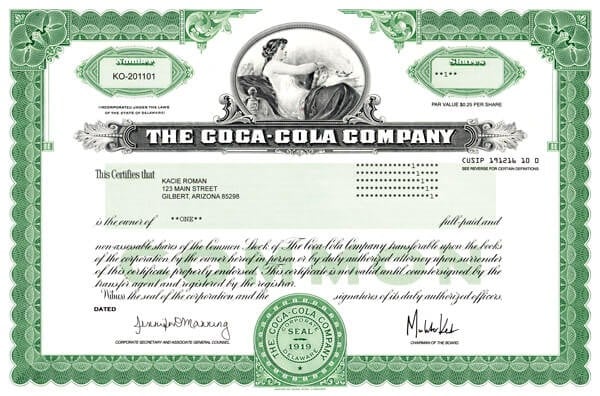

3. Already own shares electronically at a broker?

- Buy realistic-looking replica stock certificates to proudly display.

- Personalized with your name, #shares, where held.

- See list of personalized replica stock certificates

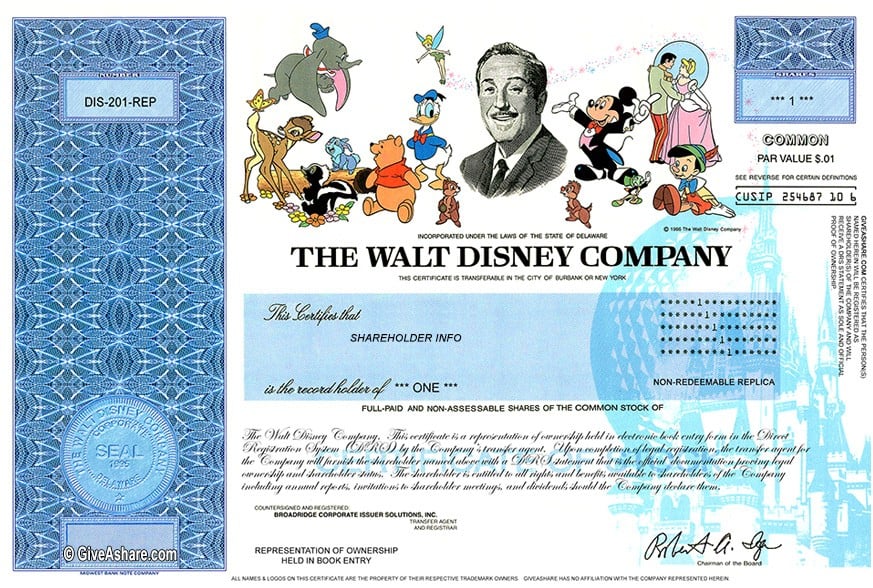

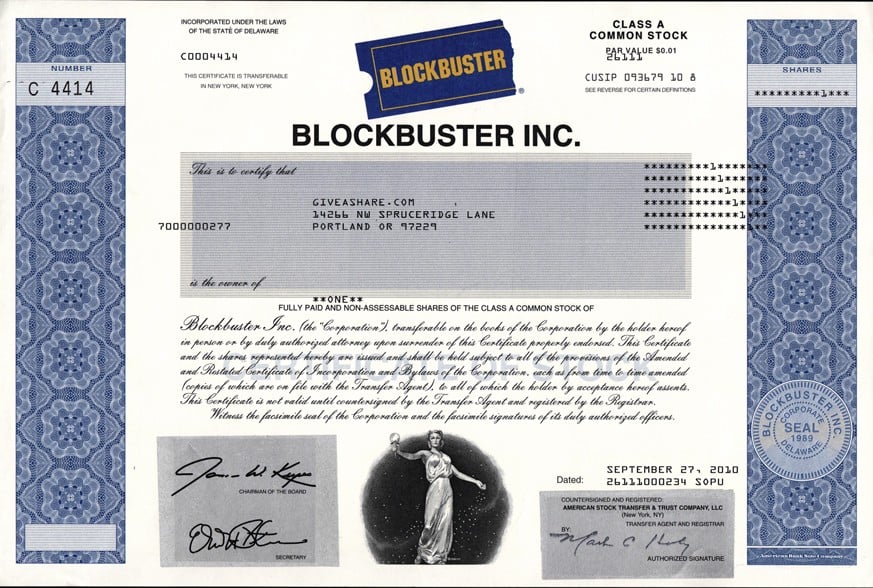

4. Buy collectible stock certificates

- Stock certificates we had registered in our company name before the underlying company away.

- See list collectible stock certificates.

Stock Certificates The Next Dodo Bird?

The securities industry has been moving to eliminate paper stock certificates for years and has made a lot of progress. With that effort, along with corporate mergers and bankruptcies, original stock certificates are becoming more rare which can increase their collectible value. Get one while you still can. See more about the demise of paper stock certificates.